The Importance of Travel Insurance for Families.

The Importance of Travel Insurance for Families.

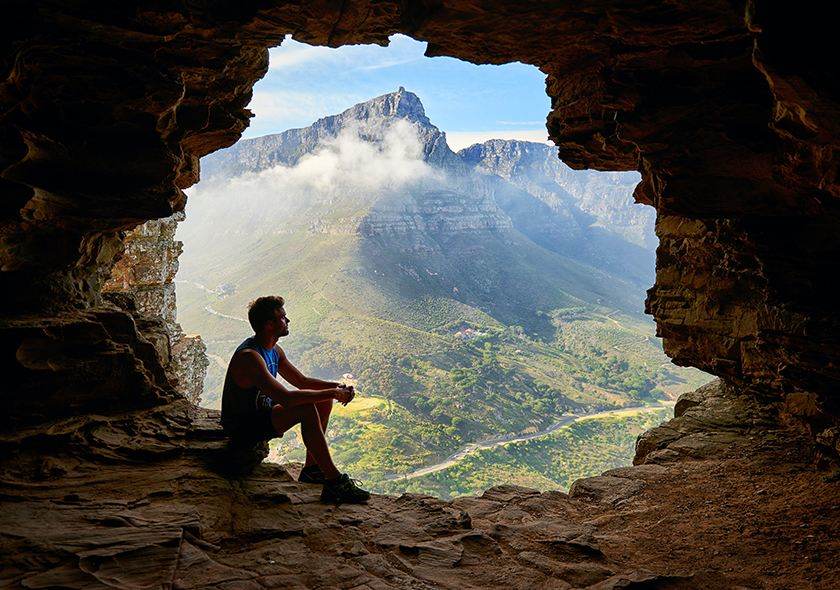

Traveling as a family is one of life’s most enriching experiences. Whether you’re venturing across the country or heading to an exotic destination overseas, family travel fosters bonding, creates cherished memories, and offers children a valuable window into the world. However, it also comes with a unique set of risks and unpredictable moments—especially when children are involved.

From canceled flights and medical emergencies to lost luggage and natural disasters, unexpected situations can quickly turn a dream trip into a logistical and financial nightmare. That’s where travel insurance becomes not just a safety net, but a smart and essential part of any family travel plan.

In this blog, we’ll explore why travel insurance is so important for families, what it covers, how to choose the right policy, and how it can give you peace of mind when exploring the world with your loved ones.

Why Families Need Travel Insurance

While solo travelers and couples often weigh the cost-benefit of insurance, for families, the stakes are simply higher. Children, elderly family members, and anyone with underlying health conditions increase both the likelihood and potential impact of travel disruptions.

Here are a few key reasons why travel insurance is essential for family trips:

1. Kids Get Sick—Often at the Worst Time

Children have developing immune systems and tend to get sick more frequently than adults, especially when exposed to new environments, climates, and bacteria. A simple cold can escalate into an ear infection or stomach virus that requires medical attention while abroad.

Without insurance, even a routine doctor’s visit in another country can be expensive—let alone emergency care or hospital admission.

2. Accidents Happen on Family Adventures

Many family trips include outdoor activities—hiking, biking, swimming, or even amusement parks. These exciting experiences increase the chance of injury. A fall or twisted ankle may seem minor but can incur major costs when treated in a foreign hospital.

Travel insurance can help cover emergency treatment, prescription medications, and even medical evacuation if needed.

3. Cancellations Are More Likely with Kids

Children are unpredictable. One moment they’re healthy, and the next, they have a high fever or contagious rash. If a child becomes ill before departure, your entire family might have to cancel or delay the trip—often after non-refundable flights, tours, or hotel bookings have already been paid.

Trip cancellation coverage can reimburse these costs and help you rebook when the time is right.

4. Lost Luggage Can Be a Nightmare for Families

Imagine arriving at your destination without your child’s clothes, diapers, medication, or special toy. Lost luggage is inconvenient for anyone, but it can be especially disruptive when traveling with young children.

Travel insurance often covers delayed or lost baggage, so you can purchase essentials and be reimbursed.

5. Travel Disruptions Can Be Costly

Weather delays, strikes, or sudden changes in transportation plans can force families to spend extra nights in hotels or rebook flights at premium prices. With several travelers in your group, these costs add up fast.

Insurance with trip interruption coverage can help you recover those extra expenses.

What Travel Insurance Covers (and What It Doesn’t)

Not all policies are created equal. While coverage varies between providers, most family travel insurance policies include the following:

Common Coverage Options:

- Trip Cancellation and Interruption: Reimbursement for non-refundable costs if your trip is canceled or cut short due to illness, injury, or unforeseen emergencies.

- Emergency Medical Expenses: Coverage for doctor visits, hospital stays, ambulance fees, and more while traveling.

- Medical Evacuation: Transportation to the nearest qualified medical facility or return home if necessary.

- Lost, Delayed, or Damaged Baggage: Reimbursement for lost luggage or essential items purchased due to delayed baggage.

- Travel Delay: Compensation for meals, accommodations, and transportation during delays.

- 24/7 Assistance Services: Access to multilingual hotlines for help with emergencies, medical referrals, or replacing lost documents.

What’s Typically Not Covered:

- Pre-existing conditions (unless specified)

- Routine medical care

- Injuries from risky or extreme sports (unless added)

- Cancellations for personal choice (unless “cancel for any reason” coverage is selected)

- Poor weather unless it leads to actual travel disruptions

It’s essential to read the policy details and understand the limits and exclusions before purchasing.

Choosing the Right Travel Insurance for Your Family

Selecting the best policy involves more than picking the cheapest option. Here’s what to consider when buying travel insurance for a family:

1. Comprehensive Coverage

Choose a plan that covers all the major risks, including medical emergencies, trip cancellation, baggage loss, and travel delays. Make sure all family members, including children, are covered under the policy.

2. Medical Coverage Limits

Look for policies that offer at least $100,000 in medical coverage and $250,000 in medical evacuation. Healthcare costs can vary widely between countries, and high limits ensure you’re protected even in worst-case scenarios.

3. Family-Friendly Plans

Some insurers offer “kids free” coverage where children under a certain age are included at no additional cost. These plans can offer excellent value for families.

4. Coverage for Pre-Existing Conditions

If you or a family member has a pre-existing medical condition, look for a policy that offers a waiver if purchased within a specified time frame after booking your trip.

5. Travel Frequency

If you travel more than once a year, consider an annual family travel insurance plan. It’s often more economical than buying a separate policy for each trip.

Real-Life Scenarios: When Travel Insurance Saved the Day

Case 1: Illness Before Departure

A family of five was planning a long-awaited trip to Hawaii when their toddler developed a high fever the night before departure. They had to cancel the trip entirely. Thankfully, their trip cancellation insurance reimbursed their flights, hotel, and prepaid excursions, allowing them to rebook for a later date.

Case 2: Hospital Visit Abroad

During a road trip through Spain, a teenager in the family broke her arm while hiking. The family rushed to a local hospital, where travel insurance covered all expenses, including diagnostics, treatment, and follow-up care.

Case 3: Lost Luggage Woes

On arrival in Tokyo, a family’s checked bag—with all the baby essentials—was nowhere to be found. With travel insurance, they were reimbursed for emergency purchases like diapers, formula, and clothing.

Tips for Using Travel Insurance Effectively

- Buy Early: Purchase insurance soon after booking your trip to ensure maximum coverage (especially for cancellations).

- Keep Documentation: Save receipts, medical reports, and emails related to any claims.

- Know Emergency Numbers: Store the insurer’s emergency hotline in your phone and on paper.

- Inform All Family Members: Make sure older kids and teens know the basics of your policy and how to seek help in emergencies.

- Use the Mobile App: Many insurers offer mobile apps with claim filing, policy info, and assistance services.

Final Thoughts

Travel insurance is more than just a line item in your trip budget—it’s a powerful tool for protecting your family from the unpredictable. While no one likes to imagine emergencies or mishaps while on vacation, being prepared ensures that you can handle them with confidence if they arise.

By investing in the right policy, you’re not just buying financial protection—you’re securing peace of mind. And with that peace of mind, you can truly focus on what matters: exploring the world with your family, making memories, and embracing the joy of shared experiences.

If you’d like help comparing family-friendly travel insurance providers or need a checklist of what to ask before buying a policy, let me know—I’d be happy to assist.